The future can be unpredictable, and current economic conditions have created some significant uncertainty. Many creative and marketing teams face the daunting challenge of budget constraints and cuts. Consequently, businesses across various sectors are feeling the pressure. For many, it is time to tighten their belts, but at what cost?

With resources limited, organizations find themselves rethinking their strategies and seeking out creative solutions that enable them to thrive despite financial limitations. Are these challenges sounding familiar? Read on to discover ways to protect your talent planning, key initiatives, and project implementations.

Understanding the Impact of Budget Cuts

According to the CMO Alliance’s CMO Insights Report 2025, the impact of current economic conditions on revenue varies by organization size. While 33% of enterprises report experiencing revenue challenges, a staggering 83% of startups feel the squeeze.

Budget cuts can reverberate throughout an organization, affecting staffing levels, project timelines, and overall business operations. Creative teams, in particular, find themselves forced to do more with less, jeopardizing the efficiency, originality, and effectiveness of their output. This makes it vital for companies to engage in strategic talent planning, ensuring they can mitigate the risk.

Doing More with Less: Creative Staffing Solutions You Can Implement Now

For CMOs, resource constraints have become the standard rather than the exception. Marketing budgets as a percentage of total company budgets have fallen to 10.1%, down from 13.8% in 2022. Creativity in hiring, outsourcing, and enhancing operational efficiency is not just a competitive advantage anymore—it’s often a necessity. So, here’s where teams are turning…

Freelance Talent

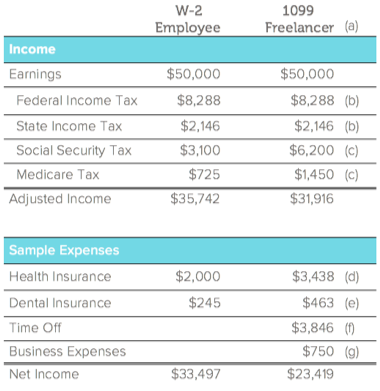

One of the most effective strategies to navigate budget cuts is to tap into freelance talent. Hiring freelancers allows organizations to maintain flexibility and achieve significant cost savings. By engaging freelancers on a short term or project basis, teams can scale their workforce up or down based on need without the long-term commitment required for full-time hires. And there’s no shortage of great freelance talent—with so many people opting to freelance, companies have many choices in nearly every field. About 64 million people worked as freelancers in 2023, and an estimated 86.5 million will be freelancing by 2027 — more than half the total U.S. workforce.

Looking for freelance talent? Here are some of the most in-demand freelance roles right now.

Creative

Marketing

Agile Project Teams

Agile Project Teams allow businesses to adapt quickly to changing priorities or seasonal demands while optimizing resource allocation. By assembling teams tailored to specific projects, organizations can leverage diverse skill sets and drive creativity in problem-solving.

These agile teams can often be assembled into a dedicated studio or flexible benches of talent for needs like overflow production, ad-hoc projects, special projects or unique capabilities.

Here are the key roles that are often critical in establishing and maintaining agile project teams or studios:

Use Technology to Your Advantage

Harnessing the right tools can dramatically improve team efficiency. Remote and hybrid working solutions have proliferated, and leveraging platforms that facilitate communication and project management can enhance productivity. Slack, Trello, and Asana streamline workflows and provide visibility into project progress, enabling teams to remain connected regardless of location.

- Project Management Platforms (PMPs)/Workflow

- Digital Asset Management (DAM) Platforms

- Re-platforming/Platform Migration

Leverage a Subject Matter Expert

Engaging with subject matter experts (SMEs) is a strategic way to optimize spending while maximizing impact. SMEs bring specialized knowledge that can enhance project outcomes without the need for permanent hires. Assess when there’s a need for specialized expertise and consider bringing in these professionals on a consultancy basis, allowing your teams to stay nimble while producing high-quality work.

Here are common initiatives where creative and marketing leaders leverage consulting expertise:

- Brand strategy

- Go-to-market strategy

- Personal development and personalization strategy

- Research and insights

- In-house agency optimization and building

- Platform optimization, implementation and integration

- Talent planning strategy

Justifying the Investment & Proving Value

According to a survey by Gartner, “proving ROI with analytics” is a top three challenge that hinders tech marketers’ ability to demonstrate success. This can make it difficult to communicate with stakeholders and secure investments. The key is to quantify the impact on business objectives by directing eyeballs to the data.

By first establishing foundational “building blocks” for metrics, data, processes, technology, and resources, you can continuously monitor, optimize, and showcase the marketing activities that align with your business objectives, as well as the talent driving these initiatives. Recognizing the importance of measurement in this way will allow you to better communicate the impact of your creative and digital efforts.

Depending on your industry, product, and target audience, choosing the right metrics will vary. Nevertheless, aligning your metrics with key objectives and formulating a strategy for your data collection will help you showcase progress toward strategic goals (such as revenue and customer growth) more successfully.

Remember, standardized processes, the right technology and tools, and a clear plan for measurement are your foundational building blocks.

Does your organization need help proving its ROI back to stakeholders? Try leveraging key roles such as a marketing analyst, digital marketing manager, SEO specialist, marketing operations manager, performance marketing manager or customer insights manager.

What’s the TLDR?

While budget cuts pose a challenge to creative and marketing teams, they also encourage innovative thinking and resourcefulness. Creative Circle is here to support businesses during times when budgets are tight, and progress is required. We’re here to provide top talent that can be deployed as freelancers, full-time staff, subject matter experts, or as a part of agile project teams. We offer flexible staffing solutions that cater to constrained budgets while helping to demonstrate the value of creative work back to the business and its stakeholders.