Most advertising creatives are “big picture” kind of people, and there are probably a great many reasons we didn’t pursue careers in law or finance — which means very few of us take the time to read the contracts we sign, or to debate the merits of being a W2 employee versus being a 1099 independent contractor.

While neither sexy nor glamorous, the paperwork you do on that first day of your job can have an enormous impact on your career and on your finances. For example, the contract you sign may limit your job opportunities once you leave the company. And depending on which tax form you fill out, you could owe a lot more at the end of the year even though you may see more in your paycheck every week.

Below is a brief explanation of all the things you’re committing to when you sign an advertising contract or fill out a form for the IRS. Don’t stop learning here — do your own research so you can protect yourself and plan for your future.

What’s in a Typical Agency Contract

It’s nothing personal against you, but advertising contracts are put in place to guarantee that employees don’t run off with an agency’s clients or try to profit off work that was created with the agency’s resources. Whether you’re an independent contractor or a full-time employee, you may need to sign a contract before you begin work.

If you’re a good, conscientious employee, you won’t have much to worry about. But it’s still worth taking a few minutes to read through the contract, especially since you’re signing a document that may limit your opportunities once you leave the company.

Non-compete Clauses

You’ve worked on a particular account, probably become friendly with their brand manager and other executives, and know their business inside and out. What’s to keep you from leaving the agency, contacting the client on your own, and proposing to do work for them at a fraction of the price the agency charged them?

A non-compete clause, that’s what. These safeguards are written into most standard agency contracts. Should you leave the agency for any reason, it’s meant to prohibit you from reaching out to their clients (or really, any of the clients who are with the agency while you are) and proposing to do work for them. Depending on the specific wording, you may also be prohibited from going to another agency and then working with certain clients, usually for a specified time like one or two years.

Ownership of Designs, Inventions, and Work Product

That website that you worked so hard on for one of your clients — conceiving it, researching it, and writing all the content? That’s not actually yours. At least, not if you’ve signed a contract with a clause about ownership of design. This is basically saying that while you’re an employee, your employer owns all the creative output produced on the premises or created using the company’s resources. That means they own it, always and forever, without you receiving any additional compensation. This also applies to things you create that have nothing to do with the company, but do on company time or using company property.

Confidentiality Agreement

This language prohibits you from revealing protected or confidential information about either the agency or its clients. However, this one isn’t always as black and white as “working for Pepsi and then running to Coca-Cola to sell the secret formula.” Where many creative people run afoul of this is by including work-in-progress or internal communications in their portfolio. Both have the potential to reveal confidential information about a company, and as such, the advertising agency could step in and take legal action against you.

If you worked on a project that you want to include in your portfolio and you’re not sure if you’re on the right side of the agreement, your best bet is to discuss this with your creative director or another executive who understands both the company’s policies and how agreeable (or not) the client in question would be. You may be given a thumbs-up, providing you strip out identifying and confidential information, and then put it on a password-protected page. Or you may be flat-out denied, which is a bummer, but it’s better than being sued.

Filling out Forms for the IRS

At your new job, you will either be considered an employee, or if you’re a freelancer, an independent contractor. Your status will have a huge impact on your paycheck, as well as how you file your taxes at the end of the year.

If you’re an employee, you’ll receive a W2 form from your employer.

Prior to your employment, you’ll fill out a form that asks for information such as your address and Social Security number. You’ll also be able to claim allowances or dependents. If you’re a W2 employee, your employer will withhold applicable taxes (Social Security, state and federal income tax, Medicare tax) as well as payment for your benefits, such as medical, dental or transit. Basically, so much will be taken out of your paycheck that you will get sticker shock, but at least at the end of the year you will owe less in taxes and may even get money back.

If you’ve claimed allowances or dependents, you’ll have less taken out of every paycheck, but you could end up owing more at the end of the year.

If you’re a freelancer or independent contractor, then you’ll receive a 1099.

Even if you’re an independent contractor, you’ll still need to fill out tax forms. But when you get your paycheck, nothing will be deducted from it. For example, if you work 20 hours at a rate of $40 per hour, then your paycheck will be $800. Technically, you are not on the company’s payroll, and when you invoice your client, you’re seen as a vendor, no different than outsourced IT or repair services.

But you are responsible for paying not only state and federal income tax on these earnings, but also both your share and your employer’s (again, that’s you) share for Social Security and Medicare taxes. Currently that amounts to 15.3% on earnings of up to $127,200, and this is on top of all the other taxes. (But at least some portion of it’s tax-deductible.) Freelancer rates are often much higher compared to regular employees, and that’s to cover all these taxes and payments, along with the fact that outside contractors aren’t eligible for benefits.

Help is available!

If you have questions, ask your human resources professional or recruiter. It’s their job to translate all these concepts into simple language and explain the impact on your finances and your life.

If you’re just starting out as a freelancer, find a good tax professional ASAP! They can give you advice on all the little things you can do to keep more of your money at the end of the year.

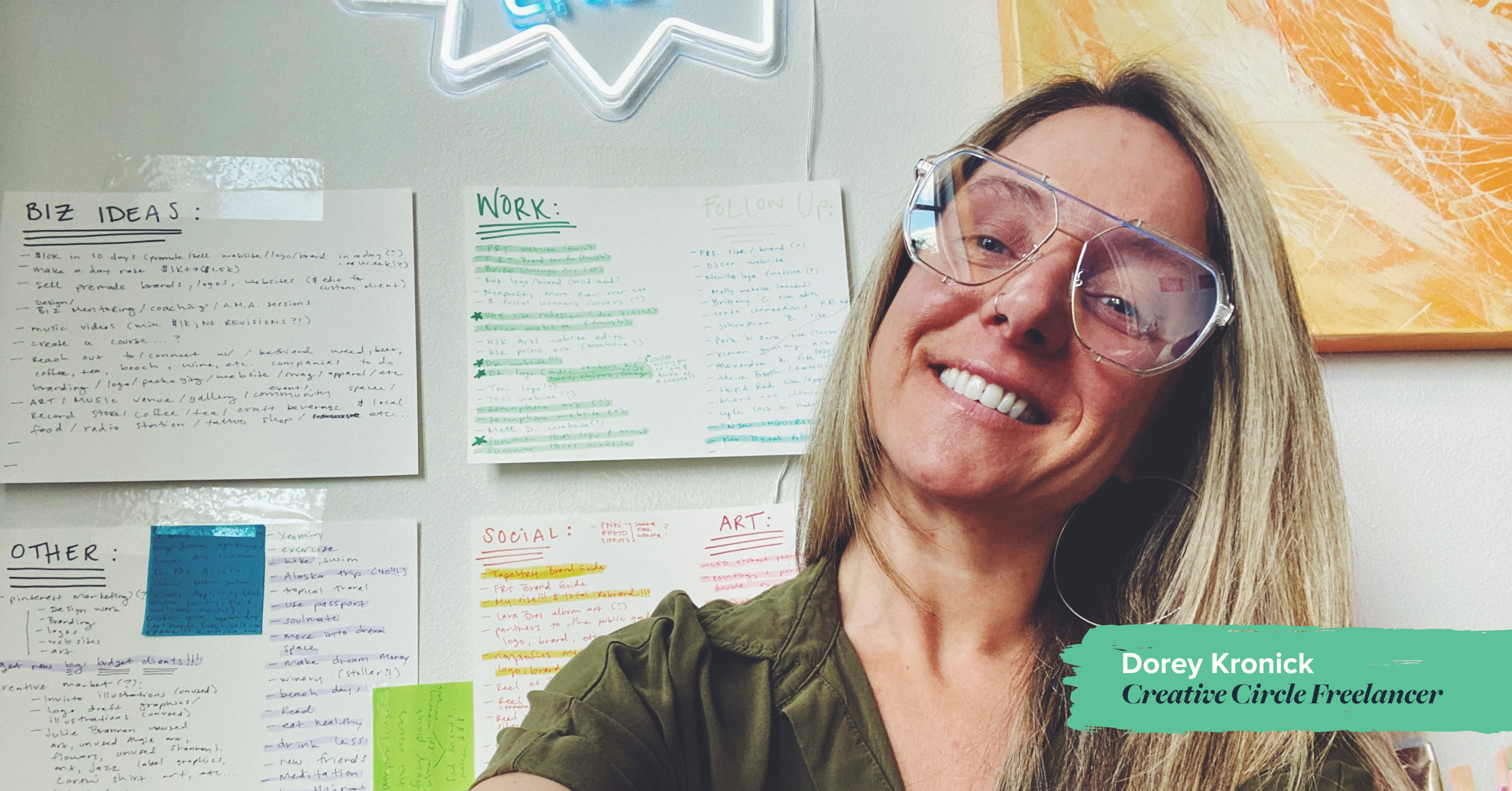

Lisa is a Creative Circle candidate and seasoned advertising copywriter who lives in Los Angeles. Her background includes both in-house and agency work on Fortune 500 and global accounts in the consumer and healthcare/pharmaceutical fields. She excels at words, fashion, and cats. If you want to work with Lisa, contact Creative Circle Los Angeles.